Law Enforcement Partners in the area

We just wanted people to be aware. Beginning on May 9th there will be sales representatives from Law Enforcement Partners in our area working on the advertising for a calendar project for the Ashland County Sheriff’s Office. The company’s information is as follows:

Law Enforcement Partners

2530 Scottsville Road, Suite 6

Bowling Green, KY 42104

The representatives that will be in the area are:

Linda Mann

Katie Nunley

If you have any questions or problems, feel free to contact our office.

Thank you.

Information Regarding the New Senate Bill 215, Effective June 13, 2022

Have you downloaded the NEW METRICH App?

The METRICH Enforcement Unit and The Ashland County Sheriff’s Office are pleased to announce the release of the “METRICH App” for public use. The METRICH App is available for both Apple and Android devices. The App will provide useful information to the public such as drug education, addiction resources, and helpful links. Users will be able to view press releases, and calendar events which are tailored to the specific counties within the METRICH region along with providing the availability to citizens to submit direct tips to METRICH detectives while remaining anonymous.

The METRICH Enforcement Unit App is the first of its kind to be used by a drug taskforce within the state of Ohio. They hope citizens within the METRICH region will take full advantage of this new platform and together they can reduce the availability of drugs that enter our community daily.

Counties within the network include Ashland, Crawford, Hancock, Huron, Knox, Marion, Morrow, Richland, Seneca and Wyandot counties. The METRICH App is not meant to be used for emergency situations. If you have an emergency, please call 911. To download the app search for METRICH in the Apple App Store or Google Play.

Amish Safety

Ohio is home to one of the largest Amish populations in the world, with many of the state's Amish communities located in northeast Ohio. It is estimated that over 36,000 Amish citizens live in Holmes County and its adjacent counties, where tourism draws millions of visitors each year.

Members of the Old Order Amish communities do not drive motorized vehicles or farm equipment, instead relying on horse-drawn buggies. Motorists must remain cautious as they share roads and highways with buggies or other horse-drawn equipment in Amish communities.

Buggies and horse-drawn equipment

Normal speeds for horse-drawn buggies range between five and eight miles per hour. Horse-drawn vehicles may travel even slower when pulling large farm equipment or when crossing intersections.

Reflective slow-moving vehicle signs, shown to the right, are mounted to the back of farm equipment and animal-drawn buggies to warn motorists of their slow traveling speeds.

The potential for restricted vision for horse-drawn vehicle drivers should also be considered. When pulling large loads of hay or other equipment, horse-drawn vehicle drivers may not be able to see cars behind them.

Driving automobiles in Amish communities

Passing horse-drawn vehicles

Automobile drivers should be extremely cautious when passing buggies and horse-drawn equipment. Motorists should pass only when legal and safe. Before passing, anticipate any left hand turns into fields and driveways, and when passing, allow plenty of room. Horses are unpredictable and passing cars may frighten even the most road-safe horses.

Traveling behind horse-drawn vehicles

When approaching a stop sign or traffic light, motorists should leave extra space – at least 10 to 12 feet – between their car and horse-drawn equipment stopped in front of them. Buggies may back up a few feet after coming to a complete stop.

While traveling behind moving horse-drawn vehicles, motorists should be aware of their closure time. Closure time is the time a driver has to recognize and respond when coming upon other vehicles. Drivers have much less time and distance to react to slow-moving vehicles than other automobiles.

Roadway hazards in Amish communities

Many Amish communities are located in the rolling hills of rural northeast Ohio. In addition to the state and federal highway system, rural roadways are important connections for the communities and tourists alike.

Rural roads are often narrower or may vary in width more than city streets. Narrow roadways provide less room to maneuver and can be especially dangerous when passing horse-drawn vehicles.

A loose gravel or grass berm area can also be hazardous.

Open ditches along rural roads are often deep and close to the road.

Seemingly open roadways may have sharp dips or unexpected turns.

In cold weather, a road shaded by trees or buildings may be especially icy.

Blind corners created by wooded areas, corn fields or other tall crops are also hazardous.

Retired Sheriff Kenneth W. Etzwiler 1934 - 2021

Today, we mourn the loss of Retired Sheriff Kenneth W. Etzwiler. Sheriff Etzwiler served as the 34th Sheriff in Ashland County from 1973-1992.

Kenneth William Etzwiler, 86 of Ashland passed away early Thursday, August 5, 2021 in the Good Shepherd Skilled Nursing and Rehabilitation Center.

He was born on December 22, 1934 in Loudonville the son of the late William and Mary Margaret (Stouffer) Etzwiler. Kenny was a 1952 graduate of Loudonville High School. He proudly served in the United States Army. Kenny married the former Louise Swainhart on September 23, 1967.

He retired in 1992 after more than 20 years as the 34th Ashland County Sherriff. He was previously employed as a Sergeant with the Loudonville Police Department and a Trooper with the Ohio State Highway Patrol.

Throughout his life he was an avid animal lover. Kenny along with his wife, Louise raised dogs and enjoyed both the outdoors and wildlife.

He was a former member of Trinity Lutheran Church, Ashland Eagles Aerie #2178, Moose Lodge #1383, Elks Lodge #1360, Post #88 of the American Legion, Ashland County Conservation League, and the Buckeye State Sherriff’s Association.

Kenny is survived by one daughter, Candice Cranmore of Tiffin; two sons, Kim (Cathy) Johnston of Phoenix, Arizona and Kirk (Mindy) Johnston of Ashland; four grandchildren, Jamie (Rick) Brightbill of Ashland, Stacey Cranmore of Georgia, Jeff Johnston of Phoenix, Arizona and Kari (Chad) Emmons of Ashland; six great grandchildren, Morgan Cranmore, Carter and Clair Brightbill, and Hayes, Lyla, and Reed Emmons; one sister-in-law, Beverly Richardson of Loudonville; and one brother-in-law, Ted (Patty) Swainhart of Perrysville.

In addition to his parents, Kenny is preceded in death by his wife of 51 years, Mrs. Louise Etzwiler who passed on September 27, 2018; three brothers, Weldon, Larry, and Leland Etzwiler; one sister, Eileen Deibler; one granddaughter, Jody Cranmore; two sisters-law, Norma Paullin and Carol Waddell; one brother-in-law, Roger Swainhart; and a son-in-law, Dan Cranmore.

Funeral services will be held, Friday, August 13, 2021 at 11:00 a.m. in the Denbow-Gasche Funeral Home with Reverend Kevin McClain officiating. Interment will follow in the Miller Cemetery where the Ashland Veteran’s Honor Guard will conduct full military honors. Friends may call one hour prior to the service from 10:00 a.m. to 11:00 a.m.

In lieu of flowers, memorial contributions may be made to Associated Charities, 240 Cleveland Avenue, Ashland, Ohio or to Ashland County Humane Society, 1710 Garfield Avenue, Ashland, Ohio 44805.

For those unable to attend, online condolences may be shared on the funeral home’s website at denbowfh.com.

Denbow-Gasche Funeral Home & Crematory is handling the arrangements.

ODJFS Creates New Hotline for Victims of Unemployment Identity Theft

COLUMBUS, OHIO – The Ohio Department of Job and Family Services (ODJFS) has established a new toll-free number for individuals to notify the agency if they believe their personal information was compromised and used to file a fraudulent unemployment claim: (833) 658-0394. This number is staffed by 50 dedicated, cross-trained customer service representatives, 8 a.m. to 5 p.m. Monday through Friday. One way victims have been discovering identity theft is by receiving an IRS 1099-G form for unemployment benefits that were never received.

The phone number complements a secure online portal ODJFS established last month to provide a direct way for victims to report identity theft. Individuals who believe their identity was stolen and used to file a fraudulent unemployment claim can visit unemployment.ohio.gov, click on the “Report Identity Theft” button and follow the guidance for individuals. This includes three steps: 1. Complete the reporting form, 2. File your taxes with IRS guidance, and 3. Protect your identity.

Identity theft is a widespread national challenge. Many Ohioans have become victims, and their identities used to file fraudulent unemployment claims in both the traditional unemployment and Pandemic Unemployment Assistance programs. Last month, ODJFS issued 1.7 million 1099-G tax forms to individuals in whose names unemployment benefits were paid in 2020. Many of those individuals were never paid unemployment benefits and did not know their identity had been compromised until they received a 1099-G form.

Unemployment Fraud Tips:

With the increased claim volumes due to the COVID19 closures, the state has seen a significant uptick in identity theft-based unemployment fraud.

If it is fraud, we suggest that the individual file a police report, place a fraud alert on their credit report and notify the Ohio Department of Jobs and Family services.

For general information on how to respond to identity theft, please see the below link. You can also submit a report at a federal level of this unemployment fraud on this site.

Website: https://identitytheft.gov/

The information to contact the Ohio Department of Jobs and Family services is below. Ohio Fraud: 1-800-686-1555 or https://odjfs2.secure.force.com/OUIOFraudReportingPortal

To put a credit freeze or credit monitoring on your accounts, please see the Credit Reporting Agency Phone Numbers and Website Information:

Equifax – (800) 685‐1111 or https://www.equifax.com/personal/credit-report-services/credit-freeze/

Experian – (888) 397‐3742 or https://www.experian.com/help/

TransUnion – (888) 909‐8872 or https://www.transunion.com/credit-freeze/

Beware of IRS Scams

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals.

The IRS doesn't initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam.

Taxpayers should be on the lookout for new variations of tax-related scams. In the latest twist on a scam related to Social Security numbers, scammers claim to be able to suspend or cancel the victim’s SSN. It’s yet another attempt by con artists to frighten people into returning ‘robocall’ voicemails.

Scammers may mention overdue taxes in addition to threatening to cancel the person’s SSN. If taxpayers receive a call threatening to suspend their SSN for an unpaid tax bill, they should just hang up.

Make no mistake…it’s a scam.

Taxpayers should not give out sensitive information over the phone unless they are positive they know the caller is legitimate. When in doubt –hang up. Here are some telltale signs of this scam. The IRS and its authorized private collection agencies will never:

Call to demand immediate payment using a specific payment method such as a prepaid debit card, iTunes gift card or wire transfer. The IRS does not use these methods for tax payments.

Ask a taxpayer to make a payment to a person or organization other than the U.S. Treasury.

Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying.

Demand taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed.

At present, the IRS does not accept bitcoin directly for paying tax obligations.

Taxpayers who don’t owe taxes and have no reason to think they do should:

Report the call to the Treasury Inspector General for Tax Administration.

Report the caller ID and callback number to the IRS by sending it to phishing@irs.gov. The taxpayer should write “IRS Phone Scam” in the subject line.

Report the call to the Federal Trade Commission. When reporting it, they should add “IRS Phone Scam” in the notes.

Taxpayers who owe tax or think they do should:

View tax account information online at IRS.gov to see the actual amount owed and review their payment options.

Call the number on the billing notice

Call the IRS at 800-829-1040.

ACSO Receives Safe Policing Certification

The Ashland County Sheriff’s Office has received Full Compliance Ohio Collaborative Law Enforcement Agency Certification status on EXEC ORDER (SAFE POLICING FOR SAFE COMMUNITIES) standards. This certification serves as a reminder of this agency's commitment to law enforcement and the community it serves.

Agencies are required to maintain Self-Certification compliance on an annual basis. Each year agencies shall maintain annual compliance documentation for all standards developed by the Ohio Collaborative Community-Police Advisory Board. This documentation is maintained by the agency and available for review by an Ohio Collaborative Law Enforcement Certification representative upon request. This compliance documentation permits each agency to prove it is complying with policy on an annual basis.

This certification would not be possible without the fine efforts of the Deputies, Corrections Officers, Detectives, Dispatchers, Administrative Staff and Maintenance Crew that keep this facility running day in and day out. And none of that would be possible without the support of the citizens of Ashland County, for which, We THANK YOU !!

Ashland County Emergency Alert Registration

Are you receiving public safety alerts? In the event of an emergency or tornado warning, an alert will be sent to the phone number(s) you provide and/or your email address. You can choose to receive a text or a voice message. Click the link, fill out the form and submit. It is that easy.

Resources for Older Adults

Did you know that Mental Health & Recovery Board of Ashland County has a page of resources for Older Adults? It’s part of the Older Adult Behavioral Health Coalition. Here is a link to it below FYI. Resources included but not limited to: Council on Aging newsletter, Area Agency of Aging Home delivered meals info, Coronavirus Disease 2019 CDC information, link to Council on Aging’s website, Staying Connected (Check in Program for 60 and over), many other resources.

Click the Link: Older Adult Behavioral Health Coalition Resources

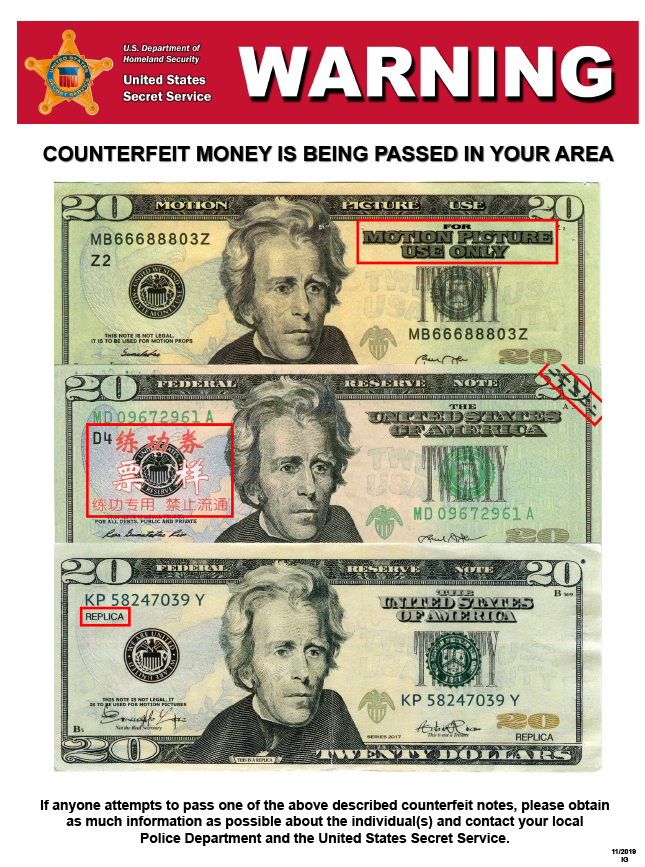

Counterfeit Notes in the Ashland Area

The U.S. Secret Service has seen an alarming recent trend in counterfeit notes passed in the U.S.

Motion Picture notes and notes with foreign writing have grown significantly. These notes account for 12 percent of all counterfeit passed in the U.S. last fiscal year; current passing levels indicate that number will unequivocally grow this year.

Motion Picture and Foreign Writing notes have been identified in all current denominations. The foreign writing may be in large, bright colors, or in smaller typeset on the front or back of the note and in various languages, including Mandarin Chinese, Russian, and Turkish.

Motion Picture Notes and Foreign Writing notes generally do not contain a watermark, optical varying ink, micro printing or fluorescing security strip. Because the words “For Motion Picture Use Only” (or similar phrases) are often clearly written on the Motion Picture notes and because Foreign Writing notes often brightly display the foreign writing (such as Chinese characters), these notes can be easily recognized as fakes with just a quick glance.

If anyone attempt’s to pass one of these counterfeit notes (see samples below), please obtain as much information, as you can do so SAFELY, about the individual(s) and contact the Sheriff’s Office or your local Police Department.